are funeral expenses tax deductible uk

Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. In order for funeral expenses to be deductible you would need to have paid.

Common Health Medical Tax Deductions For Seniors In 2022

The IRS says about funeral expenses These expenses may be deductible for estate tax purposes on Form 706 If you used estate tax money to fund a funeral then you can.

. You will need to. Many estates do not actually use. Mar 20 2016 Funeral expenses box 81.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. You may allow a deduction as a funeral expense for reasonable costs incurred for mourning for the family. The deduction of reasonable funeral expenses is specifically allowed under.

Postby exor Tue May 11 2010 412 pm. Funeral expenses paid by your estate. Funeral Costs Uk funeral costs Fees associated with the death and burial ceremonies of a person including things like a.

The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. A couple of funeral expenses are not eligible for tax deductions.

Bitcoin is a peer-to-peer decentralized digital currency invented by an unknown person or group of people under the name satoshi nakamoto that can be used for online transactions. Funeral expenses which explains that funeral expenses are payable. Individual taxpayers cannot deduct funeral expenses on their tax return.

While the IRS allows deductions for medical expenses funeral costs are not included. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Taxpayers are asked to provide a.

Introduction and general approach. You should allow as a reasonable funeral expense the cost of a headstone that finishes off describes and marks the. Any travel expenses incurred by family members of the deceased are not deductible.

Unfortunately funeral expenses are not tax-deductible for individual. Funeral expenses can be deducted from your taxes in a few different ways. This article will provide all the information you need to know about tax deductions for funeral expenses.

Funeral expenses are included in box 81 of the IHT400. However only estates worth over 1206 million are eligible for these tax. But the travelling expenses of the personal representatives or accommodation costs of mourners are not allowed You should disallow any claimed if there is worthwhile tax at stake.

HiIf a limited company has an employee die whilst working for them in an accidentAnd they volunteer to pay the funeral expenses. The IRS views these. IHTM10375 - Funeral expenses box 81.

The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. The IRS says about funeral expenses These expenses may be deductible for estate tax purposes on Form 706 If you used estate tax money to fund a funeral then you can. Feb 21 2020 Learn.

In other words funeral. You may be interested to read Practice note Possession of a deceased body. Aug 26 2015 The only time that the IRS.

IHTM10373 - Funeral expenses box 81. You can deduct funeral expenses from the value of the estate plus a reasonable amount for mourning.

Is The Travel Expense Tax Deductible For The Death Of A Parent Abroad

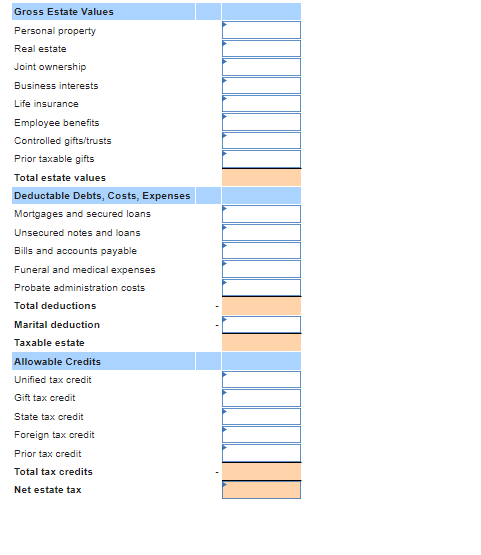

Exploring The Estate Tax Part 1 Journal Of Accountancy

Deducting Court Ordered Restitution Dallas Business Income Tax Services

Crowdfund A Funeral A New Way To Cover Funeral Costs Us Funerals Online

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Are Funeral Expenses Tax Deductible It Depends

03 Chapter 4 Deductions From Gross Estate Part 01

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible It Depends

5 Tax Deductible Expenses For Executors Fifth Third Bank

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

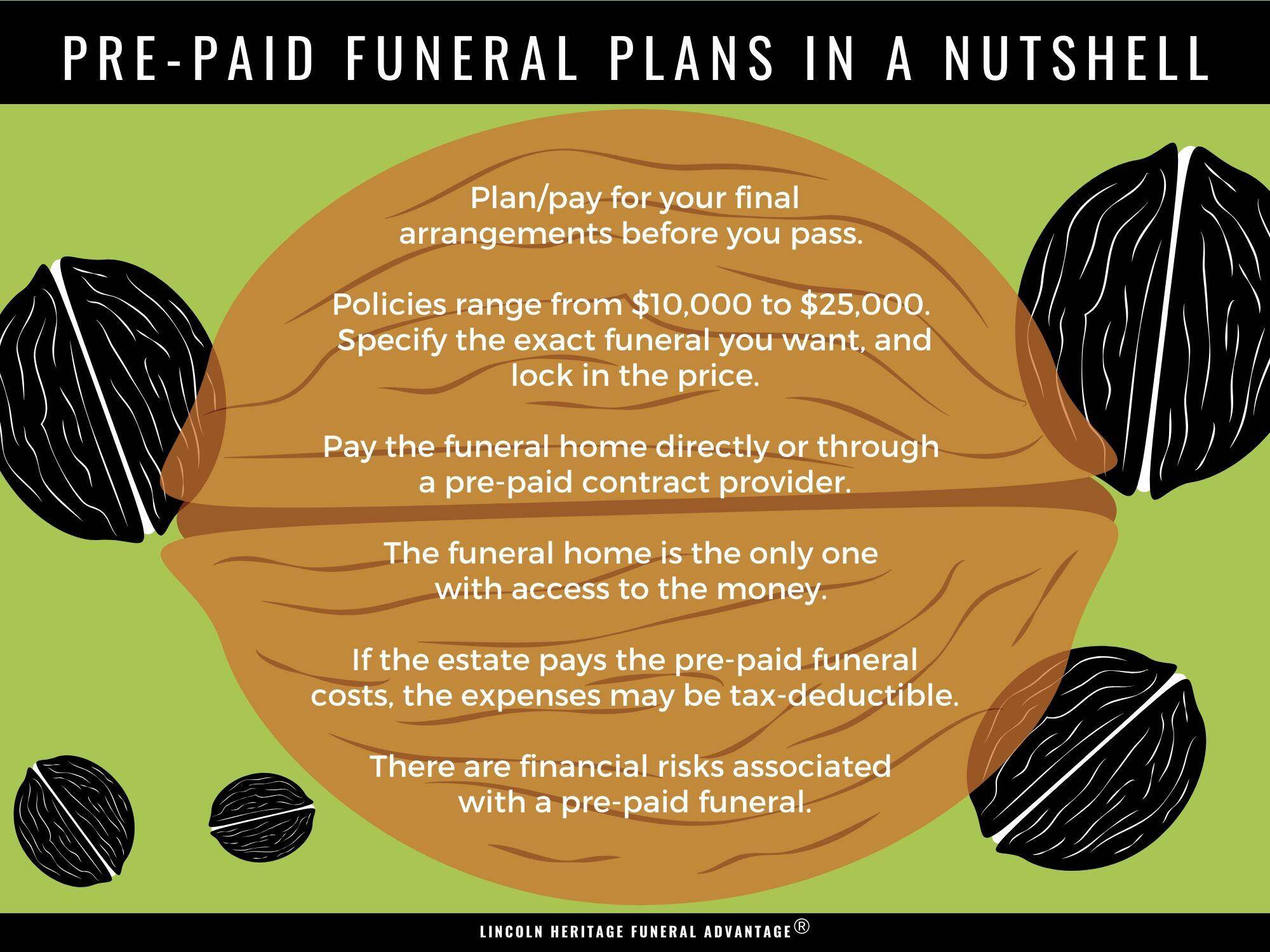

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Are Funeral Expenses Tax Deductible Youtube

Are Funeral Expenses Tax Deductible It Depends

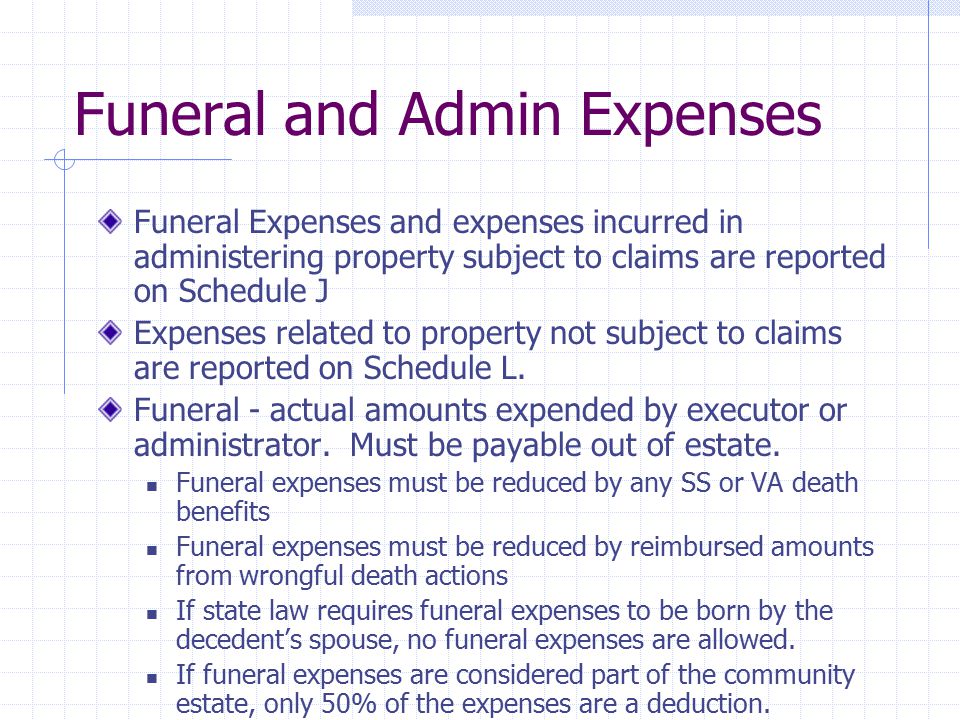

Estate Deductions Elections And Payments Of Tax Ppt Download

How To Use A 401 K For Funeral Expenses

Continuing Case 69 Estate Tax Estimate Jamie Lee And Chegg Com

Solved 5 The Decedent Is A Married Man With A Surviving Spouse With The Course Hero